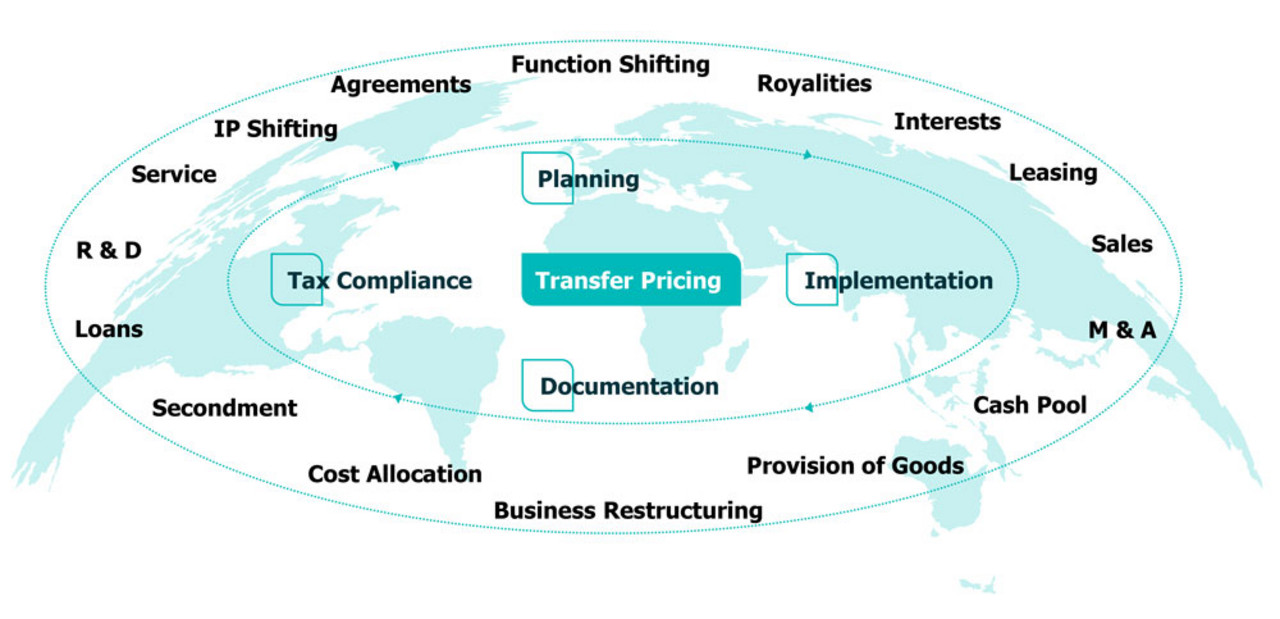

Companies operating internationally that have cross-border exchanges of goods and services between the members of their corporate groups (intercompany transactions) have to diligently watch for transfer pricing issues in their intercompany transactions and often must document how their transfer prices were set.

In view of the growing global exchange of goods and services within corporate groups, tax authorities have increasingly focused on them and examine such intercompany transactions in tax and government field audits. The complexity of worldwide transfer pricing regulations in connection with strict tax laws can quickly result in tax risks and repercussions, which should be avoided. That is why is important to have experts with many years of experience in the area transfer pricing at your disposal.

Nexia’s transfer pricing experts can offer you advice on all of the issues surrounding transfer pricing in over 120 countries. Our consulting approach is to support you in planning, setting and documenting transfer prices as well as to defend your transfer pricing policy in a tax or government field audit. We at Nexia are also there with you in dealing with mutual agreement processes. The international experts of the Nexia network can assist you in fulfilling not only the high tax law requirements specific to Germany but also to those in other countries in which the members of your corporate group are located and in your having successful outcomes in audits and legal disputes.

Your 45-minute Check: Transfer Pricing Easy & Practice Oriented

International tax authorities scrutinise companies operating in several countries more closely. Transfer pricing is no longer a fringe issue neither for multinational companies nor for tax authorities. On the contrary, it has become a key audit matter. Where does your company currently stand? What risks lurk – and where are hidden opportunities?

In an initial conversation free of charge with our Nexia experts you can find out:

- How your current transfer pricing situation is to be assessed

- What the tax pitfalls are and how much optimising potential exists and what useful steps can be taken to mitigate tax risks

- Answers to your specific questions – direct from practical experience and not out of a textbook.

Your Benefit: In only 45 minutes you will gain clarity and have a well-founded basis for taking the next steps – before this issue pops up in an audit and is much more expensive to deal with.

Arrange your initial discussion free of charge and gain clarity on the next steps you need to take to mitigate any potential tax risks when working in an international business environment.

2025

The US government passed a comprehensive draft law called the 'One Big Beautiful Bill' (OBBB). Some of the planned short-term measures, particularly those set out in Section 899, were eliminated during the legislative process and are not included in the final law.

Recent U.S. tariff increases pose new challenges for German companies, particularly for existing transfer pricing systems, which require critical review and potential adjustment.

On April 2, 2025, the German Federal Ministry of Finance (BMF) published a fact sheet on the so-called transaction matrix pursuant to Section 90 (3) Sentence 2 No. 1 in conjunction with Section 90 (4) Sentence 3 of the Fiscal Code (AO), in which it sets out its interpretation of the specific format.

A parent company of a corporate group with a legal seat or management headquarters in Germany, which discloses consolidated financial statements, is to prepare a Country-by-Country Reporting (CbCR) of the corporate group after the close of the financial year being reported on and is to transmit this report electronically to the Federal Central Tax Office (BZSt).

Section 3 of the Minimum Tax Act [Mindeststeuergesetz (MinStG)] regulates the legal requirements for Enterprise Group reportings and determines which information must be reported and which duties are to be fulfilled in Germany.

2024

On August 14, 2024, the German Ministry of Finance (BMF) introduced a draft to amend the transfer pricing guidelines issued on June 6, 2023. This draft focuses on new regulations concerning financing relationships, following the revision of Section 1 of the German Foreign Tax Act (AStG) and the introduction of Sec. 1 para. 3 lit d and para. 3 lit. e AStG as part of the Growth Opportunities Act. These changes significantly impact companies subject to taxation in Germany that engage in cross-border financing relationships.

Almost every company today has foreign relationships. While the free movement of capital gives companies more and more opportunities to structure their taxes, the collection of taxes poses a major challenge for countries. The disclosure of income tax information through pCbCR is intended to counteract this tax avoidance and create more transparency.

The draft bill for the Growth Opportunities Act originally provided for the introduction of an interest rate cap to limit the amount of interest deducted by a company. However, this was removed from the law. Instead, special regulations have been introduced in Section 1 (3d) and (3e) AStG, which specify the arm's length comparison for financing relationships.

As part of the Business Europe Framework for Income Taxation (“BEFIT”) package, published on September 12th, 2023, a proposal for issuing a European Directive, aimed at harmonising the EU regulatory framework on transfer pricing (“TP Directive”), was issued by the European Commission.

Transfer Pricing - Legal requirements for international supply and service relationships between related group entities.

Contact person

Do you have any questions or do you need support?

Please contact our specialist.

You will find a complete overview of our contact persons on our team page.

LinkedIn

LinkedIn Xing

Xing Email

Email